Students "take control of their lives" when they master personal financial management skills

For every student, university life is not only a time to study and acquire knowledge but also a period of discovery and maturity. And one of the important skills for students to be independent, confident in asserting themselves, succeeding and "mastering their lives" is mastering personal financial management skills. So what role does personal management play in students' lives? How to apply the 6 jars principle and some measures to avoid black credit traps? Let's find out through the article below!

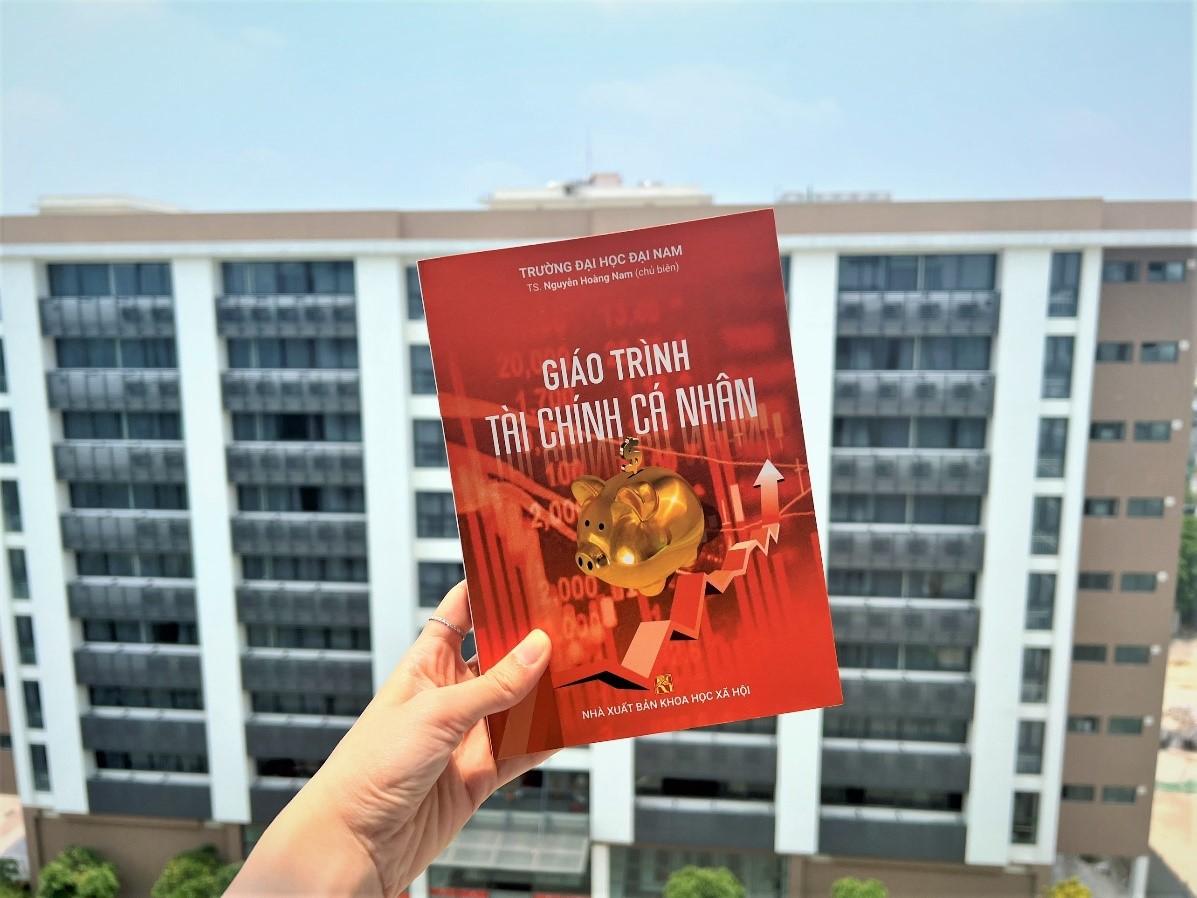

Dai Nam University teaches Personal Finance to students from the first year, and is also the only school in Vietnam to publish a curriculum on this important skill.

The role of personal financial management skills

Personal financial management skills are not simply about organizing and managing the money in your bank account. It is also a powerful tool to help students build a solid financial foundation and ensure financial freedom in the future. With this skill, students are able to manage and use money intelligently, effectively and with purpose.

Personal financial management helps students:

- Financial planning: Set financial goals, prioritize spending and saving to achieve your dreams and plans in life.

- Save and invest: Develop a savings habit early and learn about investment opportunities to increase your income and build personal wealth.

- Avoid Debt: Understand the effects of debt and avoid falling into the black credit debt trap.

- Set financial goals: Define short-term and long-term financial goals, from saving for everyday expenses to saving to buy a house, start a business or travel far away.

Getting used to saving and investing from a young age will become part of your lifestyle and benefit students long into the future.

Apply the 6 jar rule

The 6 Jars Rule is a personal finance management method that helps students organize and allocate money appropriately. According to this rule, students divide their money into 6 main spending categories:

- Daily expenses: For necessary expenses such as rent, electricity, water, food...

- Savings: To save for long-term or emergency financial goals.

- Financial Freedom: Invest to increase income and accumulate assets.

- Education: use part of your income to learn new knowledge from books, short courses...

- Enjoyment: For entertainment, going out, shopping for non-essential items.

- Charity: Set aside a portion of your income to help those in less fortunate circumstances.

Applying the 6 jars principle will help students know exactly how much money to spend on each expense, avoid waste and ensure financial balance.

How to avoid black credit traps

Black credit is one of the major risks for students when they do not manage their personal finances carefully. To avoid falling into this trap, students can apply the following measures:

- Build a stable source of income: By working part-time, doing business or looking for scholarships, students can create a stable source of income so as not to depend on black credit.

- Learn and use credit cards wisely: If you need to use a credit card, you need to understand the terms and interest rates and avoid using the card to spend beyond your ability to repay.

- Build an emergency fund: Set aside a portion of your income to create an emergency fund to deal with emergencies and avoid having to borrow money at high interest rates.

- Learn how to save and manage spending: Students should learn and apply saving methods, limit unnecessary spending and prioritize important expenses.

- Learn about personal finance: To avoid falling into the trap of bad credit, students need to learn about the risks and strategies for managing personal finances.

To avoid falling into the trap of black credit, students need to learn about the risks and strategies for managing personal finances.

Learn financial investment early

In addition to applying personal financial management skills and the 6 jar principle, students can also take advantage of the time in college to invest financially. Investing financially while still a student brings many benefits, including discovering investment opportunities and accumulating assets early. Students can learn about investment opportunities such as stocks, investment funds or online businesses. This is an opportunity for students to increase their income, create a competitive advantage when entering life after graduation and build a strong financial future.

Early financial investment exposes students to and teaches them investment principles and strategies.

Personal financial management skills and applying the 6 jar principle are important tools to help Dai Nam University students be confident and successful on their financial path. At the same time, avoiding black credit traps is also an important factor to ensure financial stability and avoid debt problems. Apply this knowledge and financial management methods to build a strong and independent financial future.

Bui Xuan Luan - Bui Khanh Ly

Register for admission consultation 2025

scholarships and tuition support worth up to 55 billion VND

scholarships and tuition support worth up to 55 billion VND