CURRENT STATE OF MERGERS AND ACQUISITIONS (M&A) ACTIVITIES IN VIETNAM

Posted date 17/05/2016

29.467 view

M&A is an economic activity that has been growing strongly for a long time in the world. In Vietnam, this activity has just started but is increasingly vibrant and promises an explosion in the coming time, although current understanding of it is still very limited.

MSc. Ngo Thuy Ninh - Faculty of Finance and Accounting

M&A is an economic activity that has been growing strongly for a long time in the world. In Vietnam, this activity has not started for long but is increasingly vibrant and promises an explosion in the coming time, although current understanding of it is still very limited. Therefore, this article aims to introduce a system of basic issues related to the M&A process and analyze the practical application of M&A activities in Vietnam. One of the key theoretical issues that need to be mastered when conducting M&A activities is mentioned as the factors that create added value after M&A. The article also fundamentally analyzes the results and limitations of M&A activities to date as well as the opportunities and challenges for M&A activities in the coming time.

1. M&A and its benefits

Nowadays, M&A is commonly called “mergers and acquisitions” (some people also call it “mergers and acquisitions”). Merger is a form in which two or more companies combine into one and create a new legal entity, a new company instead of operating and owning separately. For example, Daimler-Benz and Chrysler merge into a new company called DaimlerChrysler. There are 3 types of mergers: horizontal, vertical, and conglomerate. Horizontal mergers are mergers between two companies operating in the same field, for example, between two banks merging with each other; Vertical mergers are mergers between two companies located on the same value chain, leading to the forward (for example, a clothing company acquires a chain of clothing retail stores) or backward (for example, a milk company acquires a packaging, bottling or dairy company) expansion of the merged company on that value chain; Conglomerate mergers include all other types of mergers. In contrast, an acquisition is understood as the acquisition or takeover of another company by one company without creating a new legal entity. Whether the transaction is friendly or not (takeover, eliminating competition), in all cases, an acquisition occurs when the bidder successfully gains control of the target company. This can be the right to control the target company's shares, or to acquire the business or assets of the target company. There are two ways of acquisition: acquisition of assets (Acquisition of Assets) - acquiring all or part of the assets and/or debts of the target company (target company) and acquisition of shares (Acquisition of shares) - the target company continues to exist and its assets are not affected. According to Article 17 of the Competition Law dated December 3, 2004 of Vietnam: "Enterprise merger is when one or several enterprises transfer all of their assets, rights, obligations and legitimate interests to another enterprise, and at the same time terminate the existence of the merged enterprise. Enterprise acquisition is when an enterprise buys all or part of the assets of another enterprise enough to control, dominate all or one of the business lines of the acquired enterprise" Although different, the common point of both merger and acquisition is to create resonance, creating value much greater than the value of each individual party (synergy). That is the ultimate sign of success or failure of an M&A deal. It should also be noted that, because of that common benefit, these two terms are used together and can represent each other. Synergy is the most important and magical motive that explains every M&A deal. In general, the benefits from synergy that companies expect after each M&A deal often include: achieving efficiency based on scale, reducing employees and costs, implementing diversification and eliminating unsystematic risks, modernizing technology, increasing liquidity, market share, enjoying tax benefits... The key point to explain all the benefits of synergy as mentioned above is to analyze the added value (synergy) from M&A activities: Suppose company A is planning to acquire company B. The value of company A is VA and the value of company B is VB. The difference between the value of the merged company (V AB) and the sum of the values of the two individual companies is the value added (synergy) from the M&A activity: Synergy = VAB - (VA+VB The value added of an M&A deal can be determined based on the discounted cash flow (DCF) model. Potential sources of value added can be divided into four basic categories: increased income, reduced costs, lower taxes and lower cost of capital. ) + Revenue Enhancement: these increased revenues can be due to marketing benefits, strategic benefits and market power. + Cost reduction: the merged company can have lower costs, operate more efficiently than the two separate companies thanks to economies of scale, economies of vertical integration, complementary resources, elimination of inefficient management. + Tax gain: the potential tax benefit of M&A can come from the use of tax losses from net operating losses (the merged company will pay less tax than the two separate companies), the use of unused debt capacity (the ability to increase the Debt-Equity ratio after M&A, creating additional tax benefits and added value). + The cost of capital: can be reduced when two companies merge because the cost of issuance (debt and equity) will be much lower when issuing a larger amount than when issuing a small amount.

2. Current status of M&A in Vietnam in the period 2005-2015

Today, M&A activities in the world have become explosive events more than ever. According to the information provider Thomson Financial, mergers with contract values as large as the GDP of a developing country in a year will tend to appear more in the near future. In Vietnam, M&A activities are just the beginning compared to the world.

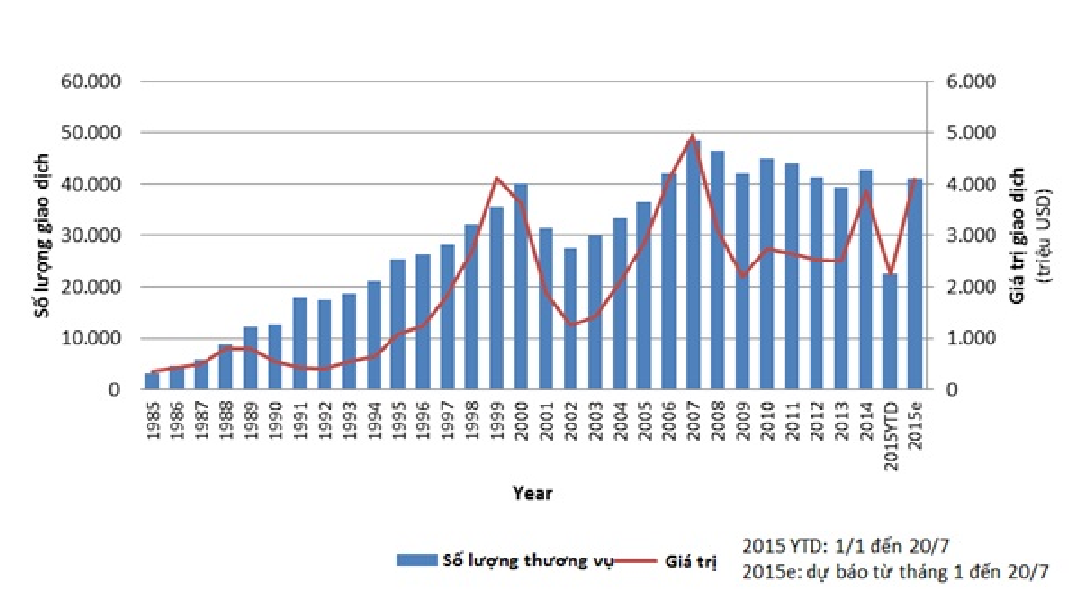

Firstly, M&A deals in Vietnam increased in both quantity and value.

The number of M&A deals taking place in 2005 was quite small, only about 18 deals. Especially since 2007, the number of business mergers and acquisitions has increased sharply in both quantity and scale, 108 deals, associated with the event of Vietnam joining the WTO on November 7, 2006. Some typical M&A deals include: in December 2006, Citigroup Inc. signed a memorandum of understanding on purchasing 10% of shares in Dong A Commercial Bank; In May 2007, VinaCapital Finance Company announced an investment of 21 million USD in Omni Saigon Hotel, equivalent to 70% of the hotel's capital... M&A activities are taking place vigorously in many different fields such as finance, banking, securities, insurance, distribution... In which, one of the pioneering fields in M&A activities in Vietnam is the wave of buying back shares to become strategic shareholders of Vietnamese joint stock commercial banks from large banking and financial groups in the world (instead of establishing a 100% foreign-owned bank).

Since 2008, M&A transactions in Vietnam have increased significantly in both quantity and value. According to Capital IQ statistics, there were 92 successful M&A transactions in 2008. In 2009, there were 295 transactions worth 1.14 billion USD, in 2010 there were 245 transactions worth 1.75 billion USD and in 2011 there were 266 transactions worth 6.25 billion USD, this number increased to 308 in 2012 and 120 transactions were made in the first half of 2013. In October 2015, information about the state divesting capital in Vinamilk with 45% of shares worth up to nearly 3 billion USD caused many foreign investors to reveal their ambitions to buy the largest listed company in the Vietnamese market. M&A activities in Vietnam in 2016 will be quite exciting. ANA Holdings Inc. – owner of Japan’s largest airline, has just reached an agreement to buy 8.8% of Vietnam Airlines shares for about 109 million USD.

1. M&A and its benefits

Nowadays, M&A is commonly called “mergers and acquisitions” (some people also call it “mergers and acquisitions”). Merger is a form in which two or more companies combine into one and create a new legal entity, a new company instead of operating and owning separately. For example, Daimler-Benz and Chrysler merge into a new company called DaimlerChrysler. There are 3 types of mergers: horizontal, vertical, and conglomerate. Horizontal mergers are mergers between two companies operating in the same field, for example, between two banks merging with each other; Vertical mergers are mergers between two companies located on the same value chain, leading to the forward (for example, a clothing company acquires a chain of clothing retail stores) or backward (for example, a milk company acquires a packaging, bottling or dairy company) expansion of the merged company on that value chain; Conglomerate mergers include all other types of mergers. In contrast, an acquisition is understood as the acquisition or takeover of another company by one company without creating a new legal entity. Whether the transaction is friendly or not (takeover, eliminating competition), in all cases, an acquisition occurs when the bidder successfully gains control of the target company. This can be the right to control the target company's shares, or to acquire the business or assets of the target company. There are two ways of acquisition: acquisition of assets (Acquisition of Assets) - acquiring all or part of the assets and/or debts of the target company (target company) and acquisition of shares (Acquisition of shares) - the target company continues to exist and its assets are not affected. According to Article 17 of the Competition Law dated December 3, 2004 of Vietnam: "Enterprise merger is when one or several enterprises transfer all of their assets, rights, obligations and legitimate interests to another enterprise, and at the same time terminate the existence of the merged enterprise. Enterprise acquisition is when an enterprise buys all or part of the assets of another enterprise enough to control, dominate all or one of the business lines of the acquired enterprise" Although different, the common point of both merger and acquisition is to create resonance, creating value much greater than the value of each individual party (synergy). That is the ultimate sign of success or failure of an M&A deal. It should also be noted that, because of that common benefit, these two terms are used together and can represent each other. Synergy is the most important and magical motive that explains every M&A deal. In general, the benefits from synergy that companies expect after each M&A deal often include: achieving efficiency based on scale, reducing employees and costs, implementing diversification and eliminating unsystematic risks, modernizing technology, increasing liquidity, market share, enjoying tax benefits... The key point to explain all the benefits of synergy as mentioned above is to analyze the added value (synergy) from M&A activities: Suppose company A is planning to acquire company B. The value of company A is VA and the value of company B is VB. The difference between the value of the merged company (V AB) and the sum of the values of the two individual companies is the value added (synergy) from the M&A activity: Synergy = VAB - (VA+VB The value added of an M&A deal can be determined based on the discounted cash flow (DCF) model. Potential sources of value added can be divided into four basic categories: increased income, reduced costs, lower taxes and lower cost of capital. ) + Revenue Enhancement: these increased revenues can be due to marketing benefits, strategic benefits and market power. + Cost reduction: the merged company can have lower costs, operate more efficiently than the two separate companies thanks to economies of scale, economies of vertical integration, complementary resources, elimination of inefficient management. + Tax gain: the potential tax benefit of M&A can come from the use of tax losses from net operating losses (the merged company will pay less tax than the two separate companies), the use of unused debt capacity (the ability to increase the Debt-Equity ratio after M&A, creating additional tax benefits and added value). + The cost of capital: can be reduced when two companies merge because the cost of issuance (debt and equity) will be much lower when issuing a larger amount than when issuing a small amount.

2. Current status of M&A in Vietnam in the period 2005-2015

Today, M&A activities in the world have become explosive events more than ever. According to the information provider Thomson Financial, mergers with contract values as large as the GDP of a developing country in a year will tend to appear more in the near future. In Vietnam, M&A activities are just the beginning compared to the world.

Firstly, M&A deals in Vietnam increased in both quantity and value.

The number of M&A deals taking place in 2005 was quite small, only about 18 deals. Especially since 2007, the number of business mergers and acquisitions has increased sharply in both quantity and scale, 108 deals, associated with the event of Vietnam joining the WTO on November 7, 2006. Some typical M&A deals include: in December 2006, Citigroup Inc. signed a memorandum of understanding on purchasing 10% of shares in Dong A Commercial Bank; In May 2007, VinaCapital Finance Company announced an investment of 21 million USD in Omni Saigon Hotel, equivalent to 70% of the hotel's capital... M&A activities are taking place vigorously in many different fields such as finance, banking, securities, insurance, distribution... In which, one of the pioneering fields in M&A activities in Vietnam is the wave of buying back shares to become strategic shareholders of Vietnamese joint stock commercial banks from large banking and financial groups in the world (instead of establishing a 100% foreign-owned bank).

Since 2008, M&A transactions in Vietnam have increased significantly in both quantity and value. According to Capital IQ statistics, there were 92 successful M&A transactions in 2008. In 2009, there were 295 transactions worth 1.14 billion USD, in 2010 there were 245 transactions worth 1.75 billion USD and in 2011 there were 266 transactions worth 6.25 billion USD, this number increased to 308 in 2012 and 120 transactions were made in the first half of 2013. In October 2015, information about the state divesting capital in Vinamilk with 45% of shares worth up to nearly 3 billion USD caused many foreign investors to reveal their ambitions to buy the largest listed company in the Vietnamese market. M&A activities in Vietnam in 2016 will be quite exciting. ANA Holdings Inc. – owner of Japan’s largest airline, has just reached an agreement to buy 8.8% of Vietnam Airlines shares for about 109 million USD.

Table 1: Number and value of M&A deals in Vietnam

Source: IMAA

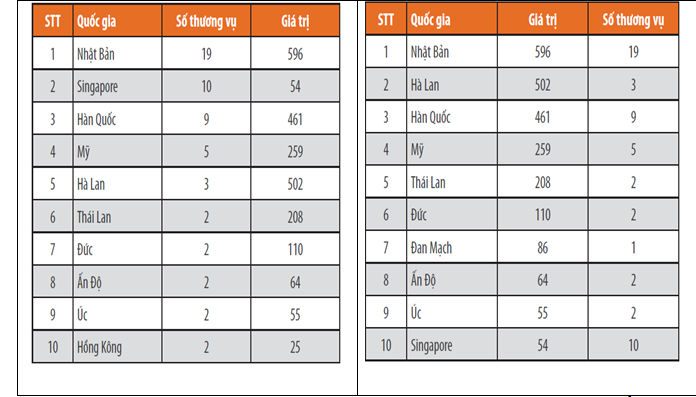

Second, large-value M&As all have foreign elements.

Statistics show that the deals that Vietnamese enterprises carry out are usually in the scale of 2-5 million USD, a few are in the range of 10-30 million USD. However, the large number of deals also proves that enterprises have been more proactive in M&A activities and are restructuring their investments. For example, transferring projects or companies that they participated in during the previous period of hot growth. In terms of deal value, the large deals all have foreign elements. Foreign investors account for 66% of the value of M&A transactions.

Table 1: 10 countries with the most M&A deals in Vietnam

Table 1: 10 countries with the most M&A deals in Vietnam

MAF Source

A review of banking M&A activities in Vietnam from 2007 to 2012 shows that there were 15 M&A deals with foreign elements, of which 10 were in 2007 and 2008. In terms of value, 2 of the 15 deals with the largest value were Mizuho buying 15% of Vietcombank shares worth 567.3 million USD in 2011 and Bank of Tokyo - Mitsubishi UFJ buying 20% of Vietinbank shares worth 743 million USD in 2012.

This shows that this activity not only takes place between domestic banks but also attracts and entices foreign partners to participate because they see that the banking market share in Vietnam still has a lot of potential for development, especially in the retail services and international payments sector.

Table 2: 15 M&A deals with foreign elementsA review of banking M&A activities in Vietnam from 2007 to 2012 shows that there were 15 M&A deals with foreign elements, of which 10 were in 2007 and 2008. In terms of value, 2 of the 15 deals with the largest value were Mizuho buying 15% of Vietcombank shares worth 567.3 million USD in 2011 and Bank of Tokyo - Mitsubishi UFJ buying 20% of Vietinbank shares worth 743 million USD in 2012.

This shows that this activity not only takes place between domestic banks but also attracts and entices foreign partners to participate because they see that the banking market share in Vietnam still has a lot of potential for development, especially in the retail services and international payments sector.

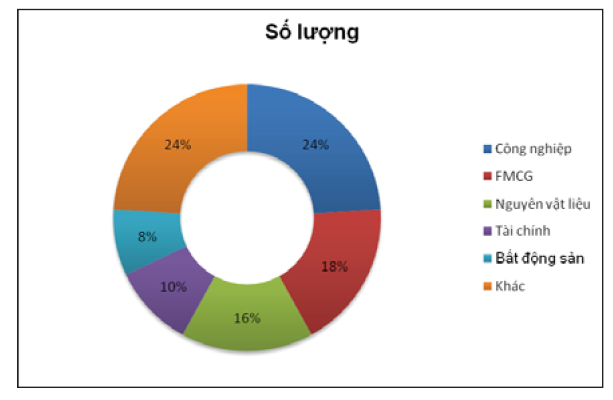

Third, banking and finance and consumer goods are the leading industries participating in M&A deals.

Banking and financial services sector with restructuring plan, this is still a potential sector for M&A and investment. Consumer goods manufacturing sector, with a market of nearly 90 million people, young population, deals in the consumer goods sector are also of interest. These deals can include the transfer of companies owning long-standing local brands or a market share with some types of goods. Manufacturing enterprises in industrial sectors always account for a high proportion because these enterprises often own valuable assets such as projects, land, factories, systems... and are suitable subjects for companies in the same industry to acquire or merge.

Table 2: M&A classified by industry

a . The legal framework for M&A activities is not yet complete.

Firstly , M&A activities in Vietnam still do not have a complete legal framework with separate regulations, but are only regulated separately and scatteredly in different laws and legal documents, such as the Civil Code, Enterprise Law, Investment Law, Competition Law, Securities Law, etc.

Second , some legal provisions may be very reasonable and correct in theory but cannot be implemented in practice.

Third , the views of state management agencies on M&A are currently inconsistent.

Fourth , many legal regulations are lacking or unclear, causing difficulties for both managers and implementers.

Fifth , current legal regulations are causing many difficulties for state management agencies when they cannot accurately determine what type of M&A transaction the enterprise intends to conduct.

Sixth , M&A deals in Vietnam are unlikely to succeed because licensing and license amendment procedures are slow and cumbersome.

Seventh , Vietnamese enterprises wishing to conduct M&A abroad cannot rely on any official legal documents, which limits opportunities to expand the market through M&A or when conducting, encounter difficulties in the methods and conditions set by the partner. b. The information system for M&A activities is still weak. In Vietnam, M&A activities between a foreign enterprise and a domestic enterprise still account for a large proportion.

b. Domestic enterprises often tend to trust the labels of foreign enterprises, so they can be blinded and ignore finding out accurate information about the company they are buying. Therefore, providing complete, clear and accurate information is an important factor leading to the success of M&A deals. However, in reality in Vietnam, this is a problem with many shortcomings, causing M&A deals in Vietnam to not go as expected.

c . The level of understanding of M&A activities of buyers and sellers is not high.

Currently, Vietnamese enterprises do not really understand the nature of M&A activities. Most of them think that the success of M&A activities depends on whether an agreement is reached at a reasonable price or not. The success of M&A is the results that M&A brings, which depends on the efforts of all members throughout the company's future operations since the M&A was signed.

d. Intermediary organizations are not yet strong:

Among the difficulties that intermediary organizations are facing, the lack of specialized human resources is the leading difficulty. This is also an inevitable consequence because M&A activities are still quite young in Vietnam, so the training of human resources in this industry is quite new, mostly from human resources transferred from the banking and securities sectors./.

REFERENCES

[1] Competition and Consumer Newsletter, No. 35 - 2012, Competition Administration Department

[2] Hogan. W, 2004, “Management of Financial Institutions”, 2nd ed;

[3] Bui Thanh Lam, “M&A in the banking sector: current situation and trends”, Finance Magazine No. 4-2009;

[4] “Stages of the M&A Process”, The Technology M&A Guidebook, http://media. wiley.com;

[5] Some articles introducing M&A on Vietnamese information sites and electronic newspapers.

Second , some legal provisions may be very reasonable and correct in theory but cannot be implemented in practice.

Third , the views of state management agencies on M&A are currently inconsistent.

Fourth , many legal regulations are lacking or unclear, causing difficulties for both managers and implementers.

Fifth , current legal regulations are causing many difficulties for state management agencies when they cannot accurately determine what type of M&A transaction the enterprise intends to conduct.

Sixth , M&A deals in Vietnam are unlikely to succeed because licensing and license amendment procedures are slow and cumbersome.

Seventh , Vietnamese enterprises wishing to conduct M&A abroad cannot rely on any official legal documents, which limits opportunities to expand the market through M&A or when conducting, encounter difficulties in the methods and conditions set by the partner. b. The information system for M&A activities is still weak. In Vietnam, M&A activities between a foreign enterprise and a domestic enterprise still account for a large proportion.

b. Domestic enterprises often tend to trust the labels of foreign enterprises, so they can be blinded and ignore finding out accurate information about the company they are buying. Therefore, providing complete, clear and accurate information is an important factor leading to the success of M&A deals. However, in reality in Vietnam, this is a problem with many shortcomings, causing M&A deals in Vietnam to not go as expected.

c . The level of understanding of M&A activities of buyers and sellers is not high.

Currently, Vietnamese enterprises do not really understand the nature of M&A activities. Most of them think that the success of M&A activities depends on whether an agreement is reached at a reasonable price or not. The success of M&A is the results that M&A brings, which depends on the efforts of all members throughout the company's future operations since the M&A was signed.

d. Intermediary organizations are not yet strong:

Among the difficulties that intermediary organizations are facing, the lack of specialized human resources is the leading difficulty. This is also an inevitable consequence because M&A activities are still quite young in Vietnam, so the training of human resources in this industry is quite new, mostly from human resources transferred from the banking and securities sectors./.

REFERENCES

[1] Competition and Consumer Newsletter, No. 35 - 2012, Competition Administration Department

[2] Hogan. W, 2004, “Management of Financial Institutions”, 2nd ed;

[3] Bui Thanh Lam, “M&A in the banking sector: current situation and trends”, Finance Magazine No. 4-2009;

[4] “Stages of the M&A Process”, The Technology M&A Guidebook, http://media. wiley.com;

[5] Some articles introducing M&A on Vietnamese information sites and electronic newspapers.

Latest article

View all Posts

Related articles

See all related Articles