Personal income tax settlement 2018

Posted date 27/03/2019

1.472 view

On March 23, 2019, the General Department of Taxation upgraded the Declaration Support application (HTKK) to version 4.1.6, updating some contents arising when implementing version 4.1.5, specifically as follows:

On March 23, 2019, the General Department of Taxation upgraded the Declaration Support application (HTKK) to version 4.1.6, updating some contents arising when implementing version 4.1.5, specifically as follows:

1. Function of printing annual financial report set (TT200/2014/TT-BTC)

- Update the correct codes of the Balance Sheet indicators:

+ Long-term unfinished production and business costs – code 241

+ Construction in progress costs – code 242

- Update the correct display position of the name "Chief Accountant" on the Business Performance Report.

2. Function to download the list of personal income tax deduction declarations for lottery and insurance companies (01/XSBHĐC)

- Automatically update the total index [12] when using the download table function on the application.

3. Function to export XML of personal income tax settlement declaration (05/QTT-TNCN)

- Update XML rendering function: do not render data of Table 05-2BK/QTT-TNCN with empty data.

4. Barcode printing function Personal income tax finalization declaration (02/QTT-TNCN)

- Update the correct name of the indicator "Total tax provisionally paid, deducted, paid in period [36] = [37] + [38] + [39] - [40]".

5. Function of declaring special consumption tax declaration (01/TTDB)

Update to remove the red warning error constraint in the total line of column 8 (indicator [I] plus indicator [II]) on declaration form 01/TTDB with column 7 in Table II on Appendix 01-1/TTDB).

Starting from March 23, 2019, when preparing tax declarations related to the above upgrade, tax-paying organizations and individuals will use the declaration functions in the HTKK 4.1.6 application instead of previous versions.

However, the error when performing tax settlement from version 4.1.5 has not been fixed yet. Specifically as follows:

In version 4.15. and version 4.1.6 when making Personal Income Tax Finalization in section 05/QTT-TNCN Finalization declaration of organizations and individuals (TT92/2015)

1. Function of printing annual financial report set (TT200/2014/TT-BTC)

- Update the correct codes of the Balance Sheet indicators:

+ Long-term unfinished production and business costs – code 241

+ Construction in progress costs – code 242

- Update the correct display position of the name "Chief Accountant" on the Business Performance Report.

2. Function to download the list of personal income tax deduction declarations for lottery and insurance companies (01/XSBHĐC)

- Automatically update the total index [12] when using the download table function on the application.

3. Function to export XML of personal income tax settlement declaration (05/QTT-TNCN)

- Update XML rendering function: do not render data of Table 05-2BK/QTT-TNCN with empty data.

4. Barcode printing function Personal income tax finalization declaration (02/QTT-TNCN)

- Update the correct name of the indicator "Total tax provisionally paid, deducted, paid in period [36] = [37] + [38] + [39] - [40]".

5. Function of declaring special consumption tax declaration (01/TTDB)

Update to remove the red warning error constraint in the total line of column 8 (indicator [I] plus indicator [II]) on declaration form 01/TTDB with column 7 in Table II on Appendix 01-1/TTDB).

Starting from March 23, 2019, when preparing tax declarations related to the above upgrade, tax-paying organizations and individuals will use the declaration functions in the HTKK 4.1.6 application instead of previous versions.

However, the error when performing tax settlement from version 4.1.5 has not been fixed yet. Specifically as follows:

In version 4.15. and version 4.1.6 when making Personal Income Tax Finalization in section 05/QTT-TNCN Finalization declaration of organizations and individuals (TT92/2015)

.png)

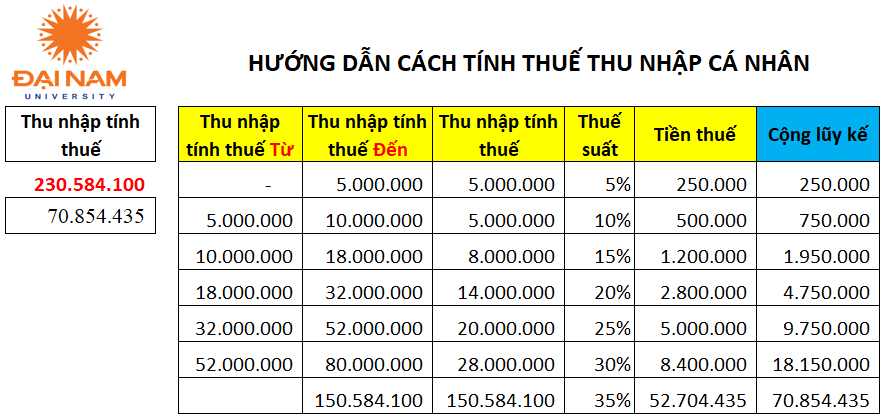

Personal income tax is not in accordance with the progressive rates prescribed in the Personal Income Tax Law.

.png)

With the proof of a person with taxable income of 230,584,100 VND, the amount of personal income tax payable is calculated as follows:

Detailed explanation as follows:

Currently, the deadline for submitting the 2018 Finalization Report is approaching. Units need to contact the direct tax management agency to receive answers to submit the Personal Income Tax Finalization Report and pay Personal Income Tax in accordance with regulations.

I wish all units and individuals to properly fulfill their obligations as prescribed by the Personal Income Tax Law.

I wish all units and individuals to properly fulfill their obligations as prescribed by the Personal Income Tax Law.

Latest article

View all Posts

Related articles

See all related Articles